Assessing Long-term Risks of the COVID-19 Pandemic on Pension Plans Using Scenario Modeling: The Power of a Story

By Daniel Reddy and Erik Pickett

Retirement Section News, July 2021

Scenario analysis for a pension plan is the process of assessing the effects of hypothetical events on the plan’s future financial position, providing tangible real-world examples of risks facing the plan. Long-term risks for a pension plan can often feel abstract. Providing strong narratives around possible future events makes it easier for stakeholders to engage with these risks and potential mitigation strategies.

Scenario modeling is most commonly used to understand investment-side risk, but is also particularly relevant for creating narratives to help understand demographic risks. It is common to assess the sensitivity of changes in key assumptions, such as a 0.1 percent change in investment return or a one-year change in life expectancy, on an actuarial valuation of pension plan liabilities. It is easy to imagine events that would lead to a 0.1 percent change in investment return, but what would actually cause a one-year change in life expectancy?

Both Middle Ground and Tail Events

Scenario modeling can give us great insight to both the middle ground (the set of reasonable estimates for future events) and tail events (events that occupy the extreme “tail” ends of a distribution).

As actuaries, we strive to provide our clients with the best “best estimate” assumptions. However, there is normally a range of values that best estimates could reasonably take. Scenario modeling allows us to explore this range of reasonable assumptions. If we focus on a range of scenarios covering the middle ground, we can assess how universal our best estimates really are.

If we focus instead on modeling the outcomes of extreme scenarios, we can gain an understanding of how resilient our funding and investment strategies are to catastrophic events. This can help us identify exposure to unmanaged risk outside our risk tolerance, highlighting where we may need to implement mitigation strategies.

The COVID-19 Event

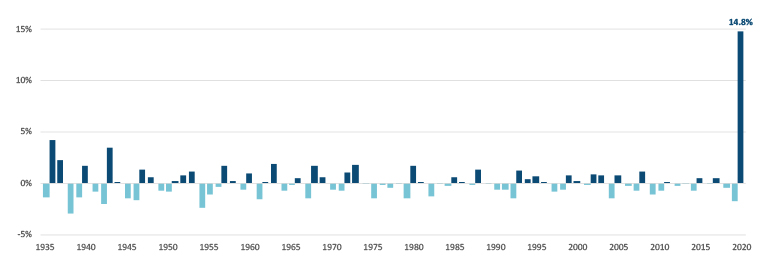

2020 was an exceptional and tragic year. We witnessed nearly 15 percent more deaths than were expected at the beginning of the year using Club Vita’s estimate of excess deaths, and elevated deaths continued into the beginning of 2021.

Figure 1

United States: Excessive Deaths Versus Underlying Trend

Source: Club Vita calculations based on data from the Human Mortality Database for years through 2018 and CDC data for 2019 and 2020. Club Vita has estimated under-reported deaths by certain states in the CDC data for September–December 2020, based on COVID-19 deaths as reported by the COVID tracking project.

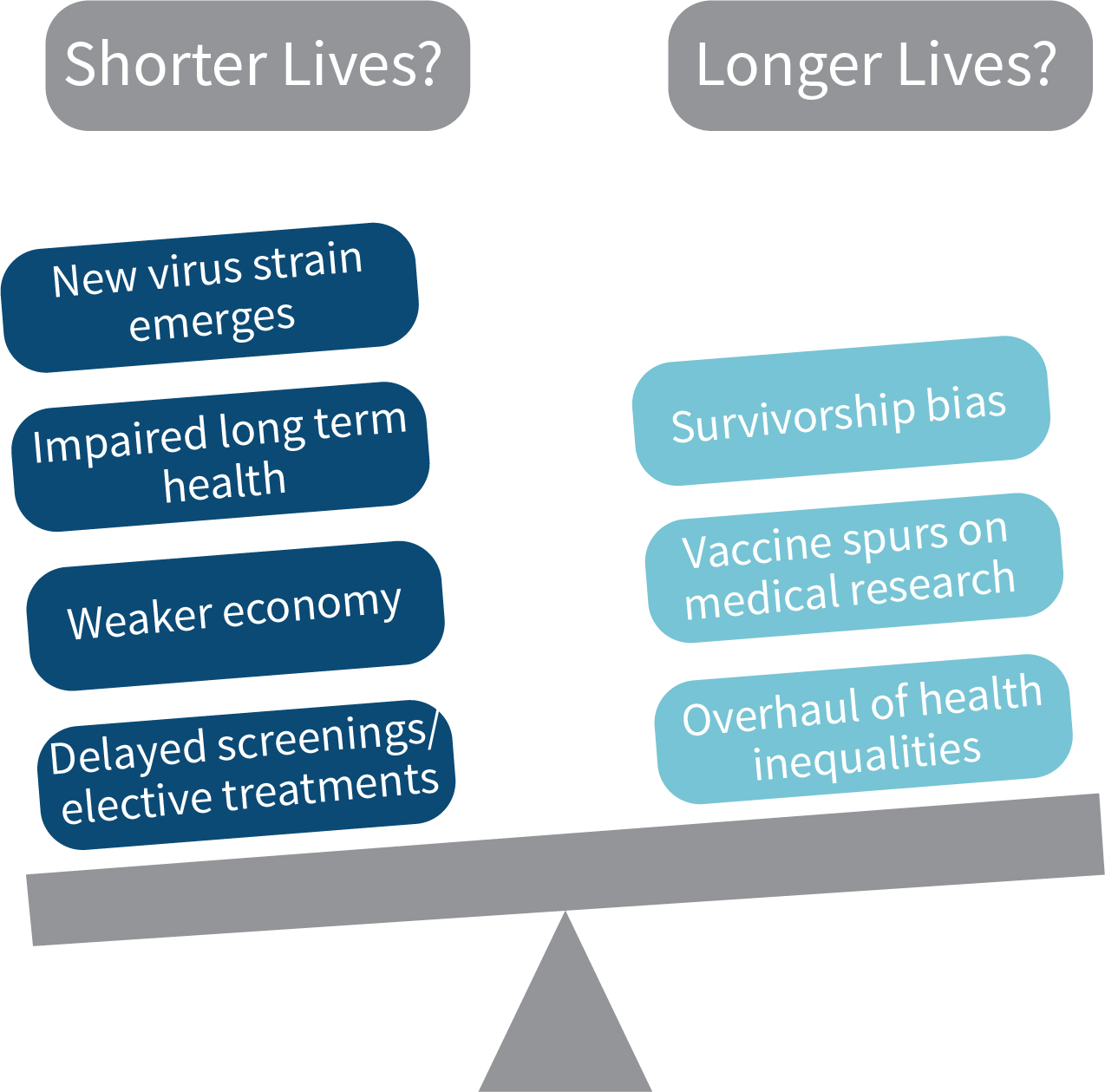

When thinking about pension plan finances, the isolated impact of 2020 excess mortality will be small. This is because we only expect a very small fraction of pension plan participants to die each year, so even increasing this number by 15 percent leads to only a modest change to future cashflows. What is more important are the subsequent effects COVID-19 may have on future improvements in life expectancy in 2021 and beyond. These effects could be both positive and negative.

Figure 2

Positive and Negative Effects of Improvements in Life Expectancy

Developing Club Vita’s Scenarios

Club Vita has developed a set of COVID-19 scenarios to help pension plan stakeholders, and their advisors, understand the longevity risks for their plans resulting from the pandemic. To develop our scenarios,

- we first created specific narratives around possible outcomes of the pandemic, considering events that will affect the severity of the pandemic and/or the longer-term outlook for longevity;

- we then analyzed how the components of these scenarios will affect key drivers of mortality; and finally

- we calculated how the stresses of our key drivers will affect life spans of pension plan participants and the resulting effect on a plan’s cashflows and present value of liabilities.

Descriptions of our Scenarios

We created four scenarios capturing a range of different outcomes, described as follows:

Bump in the Road

COVID-19 has a short and isolated effect and after a marked increase in deaths due to the pandemic in 2020 and 2021, trends return to the pre-pandemic rate, although with a couple of “lost years” of longevity improvement that will never be recovered. This results in a 0.7 percent to 1.0 percent reduction in liability.[1]

Innovation in Adversity

We experienced not only a swift recovery from the pandemic, but lessons learned during the outbreak of COVID-19 act as a catalyst for longer term improvements in health and longevity, particularly lower socio-economic groups who have been most impacted by the pandemic. This results in a 0.3 percent to 1.8 percent increase in liability.[1]

Long Road to Recovery

Challenges both to the efficacy and adoption of the vaccine mean that society and the economy are left dealing with lingering effects of the pandemic for a prolonged period. The 2020s will be a decade of sluggish economic growth and low improvements in life expectancy. This results in a 1.6 percent to 2.7 percent reduction in liability.[1]

Healthcare Decline

The effectiveness of vaccine programs is limited by emerging virus mutations and low vaccine adoption. The subsequent waves prove more deadly than those in 2020, and mortality rates remain elevated for much of the 2020s, creating a prolonged economic recession. Healthcare enters a downward spiral as our systems struggle to provide regular care during the ongoing pandemic. This results in a 3.1 percent to 5.2 percent reduction in liability.[1]

Comparison of our Scenarios

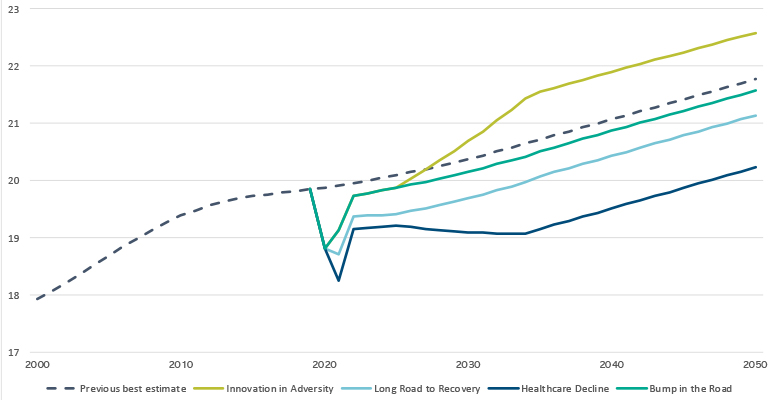

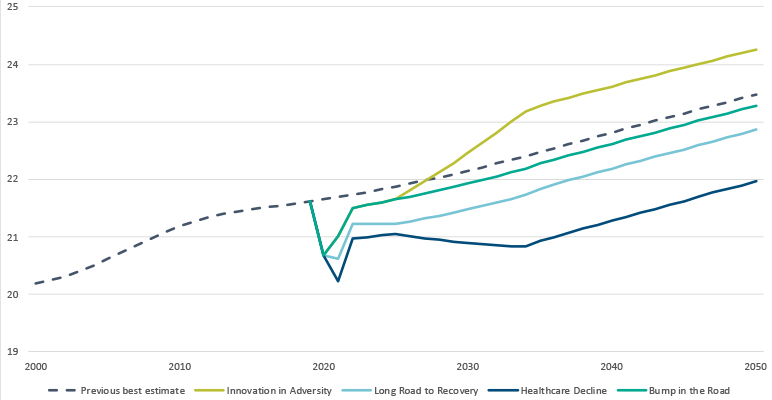

The graph below shows projected period life expectancy[2] from age 65 at each year into the future under each of our scenarios next to a typical assumption currently used by many pension plans.[3]

Period life expectancy is calculated for each year using the number of deaths occurring in that year. The extreme number of deaths experienced in 2020 and expected in 2021 mean that we see a sharp decline in period life expectancy in these years. None of our scenarios expects this level of excess deaths to continue past 2021, so we expect period life expectancy to bounce back to some degree. This serves as a warning to actuaries when constructing future life expectancy assumptions using data from 2020 and 2021.

Figure 3 Men and Women

Period Life Expectancy From Age 65

There is a significant gap in the projected life expectancy by 2035 between our most optimistic longevity scenario, “Innovation in Adversity,” and our most pessimistic scenario, “Healthcare Decline.” For a more affluent mix of lives the gap between scenarios will be smaller because each of our scenarios is more extreme in impact for lower socio-economic groups. Conversely, the gap will be larger for a less affluent mix of lives. For a typical plan, the liability impact ranges from around a 1 percent increase to a 5 percent reduction.[4]

Interaction With Other Risks

These impacts only consider longevity risk and will be compounded or offset by any related outcomes in financial markets. When stress testing the funding and investment strategies of a pension plan it is important to consider the holistic effects of a scenario on all risks to a plan.

Details on the Modeling Methodology

Further technical details on Club Vita’s COVID-19 scenarios can be found here: https://www.clubvita.us/collaborative-research/covid-19-longevity-scenarios-a-bump-in-the-road-or-a-catalyst-for-change

Daniel Reddy, FSA, EA, is the CEO of Club Vita US, LLC. He can be contacted at daniel.reddy@clubvita.net.

Erik Pickett, Ph.D., FIA, CERA, is the CCO of Club Vita. He can be contacted at erik.pickett@clubvita.net